Global Energy Wrap, July 10 - July 16

Here's a summary of last week’s top energy news that have the potential to impact global energy supply and demand.

Africa/ Nuclear power

At the Russia-Africa Forum on July 27-28 in St. Petersburg, a session "Nuclear Technologies for Africa's Development" will discuss the continent’s current nuclear projects and potential. The session is organized by Rosatom, Russia’s state-owned nuclear corporation.

Brazil/ Natural gas

Petrobras is discussing seven new potential natural gas contracts as part of efforts to increase domestic supply. The state oil and gas giant is under pressure to boost local gas supply from its offshore oil and gas projects and reduce domestic gas prices.

France/ Nuclear power

Nuclear power generation at EDF's French reactors in June rose 12.4% YoY, to 22.7 TWh. EDF's total nuclear generation in France since the start of the year was 158 TWh, up 2.6% YoY. This increase is due to the postponement of unit outages.

Germany/ Solar power

Renewables developer and services company MaxSolar secured €410 million for solar projects in Germany. The financing is provided by institutional investors Infranity, I Squared Capital and Rivage Investment (France).

Germany/ Wind power

BP will pay €6.8 billion for two licenses to develop 4 GW of offshore wind at two sites 150 km northwest of the Heligoland islands in the North Sea.This increases BP’s global offshore wind pipeline from 5.2 GW to 9.2 GW, an increase of more than 70%.

Norway/ Oil and gas

Norway’s oldest oil company, DNO, made its biggest hydrocarbon discovery in a decade. Located in the Carmen prospect in the North Sea, the site’s expected recoverable reserves is in the range of 120-230 million barrels of oil equivalent.

Renewable energy

Wind and solar projects are on track to account for more than one-third of the world's total electricity supply by 2030, indicating that the energy sector can meet global climate goals, according to a report by the Rocky Mountain Institute.

Russia/ oil

Oil exports from western ports are set to fall by some 100,000-200,000 bpd next month from July levels, a sign that Moscow is making good on its pledge for fresh supply cuts in tandem with OPEC leader Saudi Arabia.

UK/ LNG

The UK’s biggest energy supplier signed a contract for 1 million tons of LNG a year with Houston-based Delfin Midstream. When the U.S. project starts production, the deliveries will heat 5% of UK homes for 15 years.

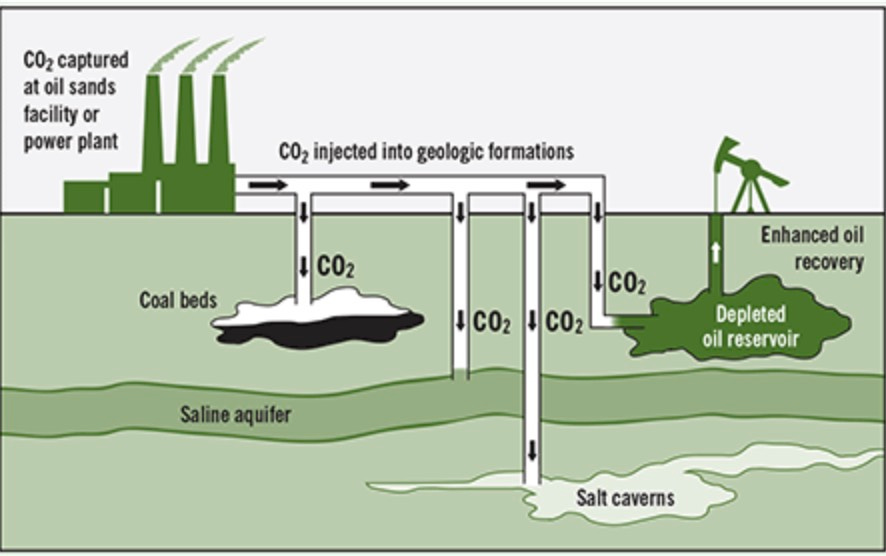

U.S./ Carbon capture

ExxonMobil will buy Texas-based oil and gas producer Denbury for $4.9 billion. The acquisition also gives ExxonMobil the largest owned and operated CO2 pipeline network in the U.S.

U.S./ utilities investment

There'll be a “seismic shift” this year in utilities’ investment, said S&P Global. Those with the highest expected net plant growth, in terms of power producing capacity, are NextEra Energy at 98.3%, Eversource Energy at 48.3%, Idacorp at 35.6%, Allete at 32.9%, and PNM Resources at 28.5%.